Monthly Investor Letter, December 2022

“My 40-plus years of experience in finance strongly recommends that investors should look at what the market says over what the Fed says.”

-- Jeff Gundlach, CEO of DoubleLine Capital

“These factors may combine to make 2023 a disinflationary year.”

-- James Bullard, President of Federal Reserve Bank of St. Louis

Great Distortion vs. Great Inflation

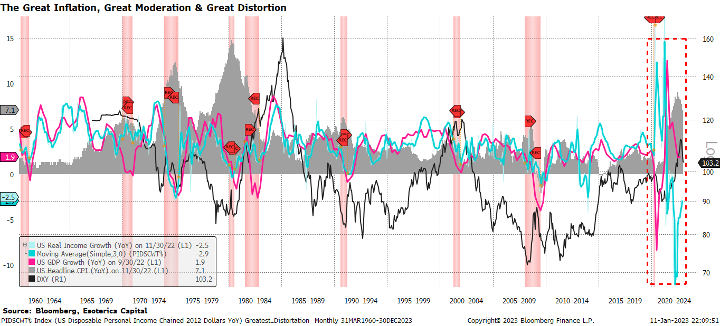

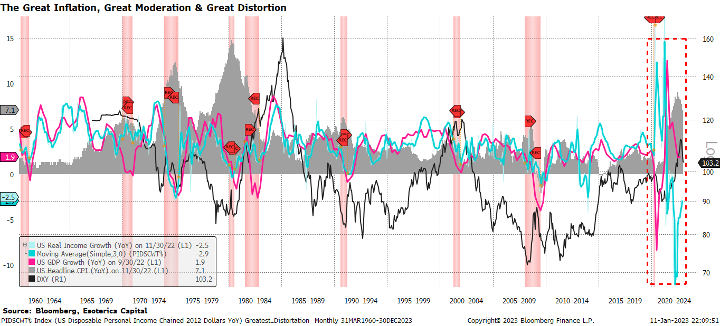

The time since the outbreak of Covid-19 will go down in history as “Great Distortion.” To make our point, one can look at how the US real income growth has been out of sync with the US GDP growth during the period, which had never happened before as far as the available data (Chart 1). In the early days (2020, 2021), unprecedented monetary and fiscal support lifted the income despite the economic growth taking a dive as the world suddenly stopped. Supply constraints (supply chain disruption, labor shortage, etc.) manifested at an unfortunate time when demand was hot: people had a lot of money and time to spare. Then inflation followed as too much money chasing too few goods. The growth quickly recovered, but the real income took a hit, mainly because of the base effect, and then soaring inflation depressed purchasing power. The Fed launched its inflation-fighting campaign by reversing the ultra-loose monetary policy to aggressive front-loaded hiking. If it succeeds, we expect income and spending growth will be back in sync again. Re-normalization is the desired destination. We are in the second half of this process.

Chart 1

Close

People like to compare the current inflation to the 70s (Great Inflation), but we believe the underlying drivers differ. First, the collapse of Breton Woods in the early 1970s led to a re-pricing of the US dollar, which lasted almost a decade (Chart 1). A weaker dollar was the tailwind to inflation. Second, labors had much stronger bargaining power, and they managed to maintain their real purchasing power. Third, two energy crises (1973, 1979) amplified the inflationary pressure as exogenous shocks. Paul Volker essentially strengthened the dollar so forcefully that inflation finally came under control (Chart 1).

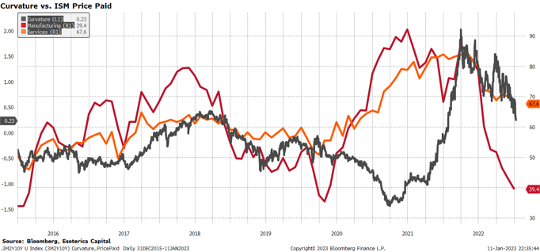

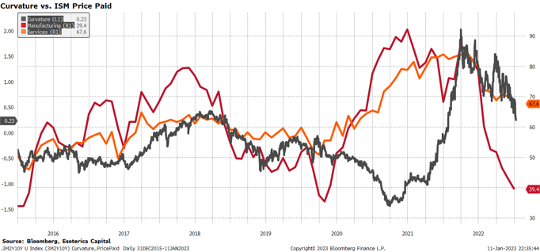

Today’s inflation is primarily distortion-induced, and re-openings have resolved the supply chain and production distortion. The Fed’s front-loaded tightening has also been very effective in correcting the monetary distortion, which was too loose compared to the inflation dynamics in 2021 (Chart 2). We believe the Fed is no longer behind the curve; it just takes time for the tightening to take effect.

Chart 2

Close

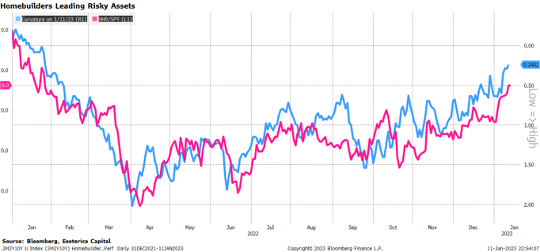

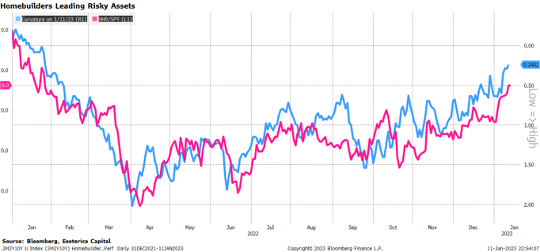

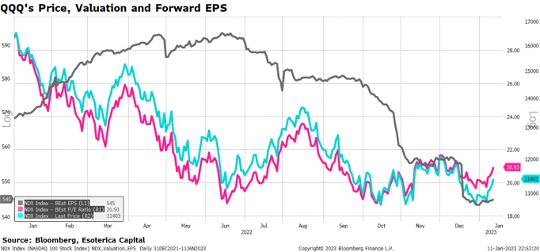

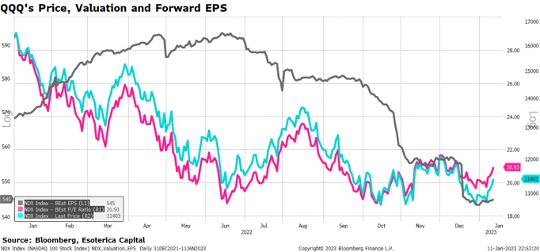

In other words, we are moving away from Great Distortion to return to normal. The peak inflation and the peak hawkishness are behind us. Chart 3 might give you the best evidence of that from markets. Our long-time readers know that we use curvature (Chart 3, inverted) to measure the marginal tightness of the Fed’s monetary policy. Homebuilders, as the most rate-sensitive sector, their equity performance is also a good proxy for the hawkishness of the Fed. We are amazed by how efficient markets are at pricing that. What is not clear is at which level the income and spending growth will settle after the distortion. This is the challenge in 2023. Earnings will continue to be revised down before the new equilibrium is attained (Chart 4).

Chart 3

Close

Chart 4

Close

Short Term Pain, Long Term Gain

We mentioned the rolling inventory correction of semiconductors and how these corrections often mark the bottoms of the stocks in previous letters. With the Nasdaq trading at the same level vs. the lowest point in mid-October, the semiconductor index is trading at 15% higher. We are in the middle of this inventory correction, and it will be a bumpy journey in the near term. The consumer market is still weak, and the distribution channel is working off the extra inventories; we are also picking up new evidence that the datacenter market may need to adjust the orders lower. Nevertheless, our assessment remains the same. When inventory correction happens, it usually creates an excellent opportunity for long-term gain. Compared to two months ago, we believe there are reasons to be more positive and look forward to a potential recovery later this year.

We saw a similar, albeit slightly delayed, dynamic in the software space. Recent CIO budget surveys pointed to a continuing deterioration, putting more pressure on the software vendors in the first half of 2023. Tech firms accelerated their headcount reduction, which negatively impacts seat-based application software. However, Satya Nadella conveyed it well, “the combination of pull-forward and recession means we will have to adjust, …, that will cycle through, …, and come out of it in what can be another massive growth cycle.”

Take a step back and look further into the future: things become much more uncertain and fuller of unpredictability. In early December, TSMC outlined a $40 billion plan to build leading-edge semiconductor facilities in Phoenix. This new plan expands the products to the more advanced 3nm chips and is a big step up vs. the initial $12 billion plan they announced in 2020.

Morris Chang, the founder of TSMC, has suggested on multiple occasions that the higher cost of building facilities in the U.S. makes it uneconomical to do that. As recent as late 2021, Morris stated, "If you want to reestablish a complete semiconductor supply chain in the U.S., you will not find it a possible task. Even after you spend hundreds of billions of dollars, you will still find the supply chain incomplete, and you will find that it will be very high cost, much higher cost than what you currently have."

However, as the world around us changes rapidly, cost and efficiency are no longer the priorities for many companies relying on a globalized supply chain. Safety is. Fast forward to December 2022, at the Arizona celebration event, joined by President Biden and the CEOs of every major US semiconductor company, Morris Chang stated, "Globalization is almost dead, and free trade is almost dead." We must think through the long-term investment implications of these new dimensions.

What is the plan for 2023, then? Taking the duration risk could deliver a better risk/reward after the peak hawkishness but ahead of the Fed’s dovish pivot. Switching to equity market beta might be worthwhile when the Fed calls off the tightening. Once embarking on the new cycle, investors should embrace the alpha truly. We will likely see the inflection point in 2023.

Esoterica's statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. For full disclosures, click here.