Monthly Investor Letter, January 2023

“It is gratifying to see the disinflationary process now getting underway, and we continue to get strong labor market data.”

-- Jerome Powell, Chair of the Federal Reserve of the United States, FOMC Press

Carving on Gunwale of a Moving Boat

We dedicated this month’s letter to some sober reflections on our mistakes last year. The daunting market environment for growth assets is a harsh reality, but it should not be an excuse. We made many mistakes along the way: underestimating the vulnerability of high-quality growth assets in light of fast-rising interest rates, failing to recognize the nature and extent of “Great Distortion” and its subsequent “Re-Normalization” early enough, and being stunned by the stickiness of inflation and the Fed’s firm resolve to put it out, etc.

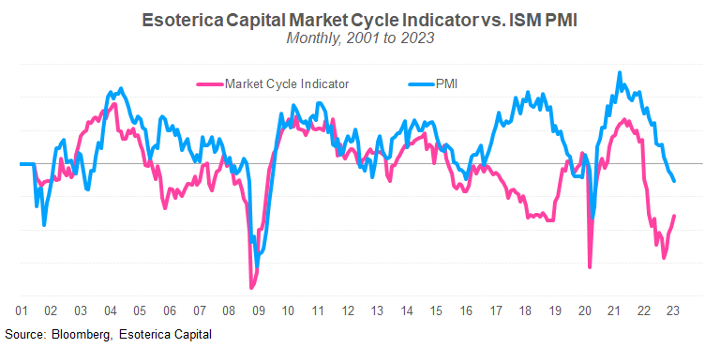

Amid them all, the biggest mistake is “carving on gunwale of a moving boat,” figuratively speaking. We knew the Fed would start the tightening process soon when Jay Powell ditched the transitory tag in November 2021, reinforced by the December FOMC meeting minutes released in January 2022. Our proprietary market cycle indicator warned us that the market risk premium was quickly deteriorating (Chart 1). Despite all these, here were our thoughts back then:

Chart 1

Close

“Not Time to Quit, but Do Choose Wisely"

Simply put, history had shown that when 1) we were at the beginning of the rate-hiking cycle; 2) the yield curve was on a flattening trend but still a bit away from inversion (60-ish bps now); 3) PMI was off the peak, but firmly in the expansionary territory, equity markets had a lot of room to run higher.

It’s not time for investors to quit taking equity risk, but we might do better if we choose the proper exposures as the cycle matures. Looking through the equity factors’ lens, which is cleaner and more consistent, we believe short value (cheap stocks) and size (small caps) and long high quality might fare better along with a flattening yield curve (a proxy for a maturing cycle).” -- Monthly Investor Letter, January 2022

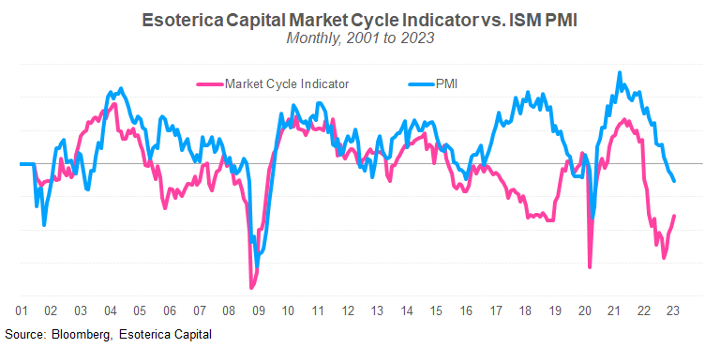

Right, at the onset of the Fed’s hiking rates, we did not aggressively cut gross and net equity exposure as we should have, in retrospect. We tried to optimize our equity exposure instead. These local optimizations turned out helpless when the overall market beta fell apart (Chart 2). We got the big picture wrong and did not get a chance to correct it until late March (the story for another day).

Chart 2

Close

Ironically, we got it wrong because we played religiously with the old book. We did not think through what is different in this tightening cycle. We subconsciously leaned toward experiences over objective, logical reasoning and, as a result, missed the true driving forces.

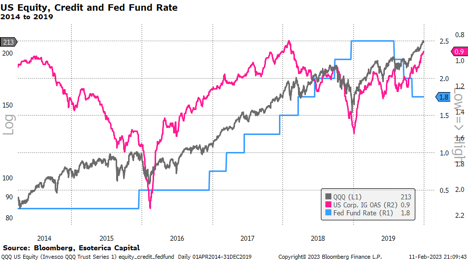

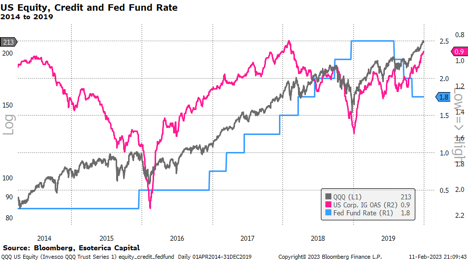

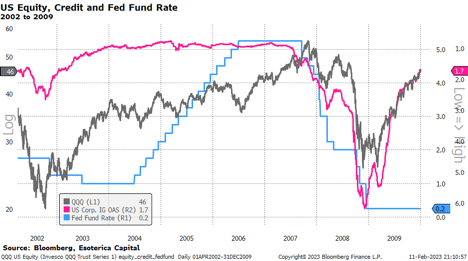

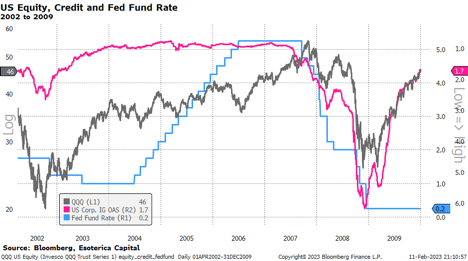

Chart 3

Close

Chart 4

Close

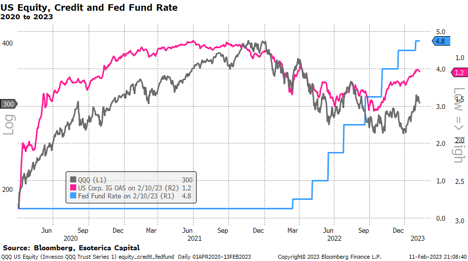

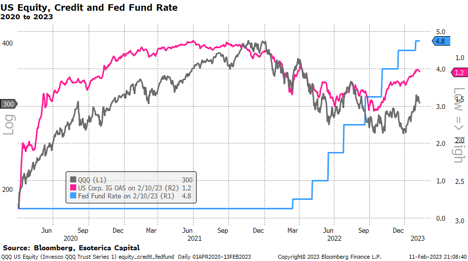

To give some concrete examples, in the previous two hiking cycles, 2015 to 2019 (Chart 3) and 2004 to 2007 (Chart 4), corporate credits (IG OAS) reached the high first, and equities were always the last man to fall. This makes sense when inflation is not a concern and growth is the driving factor of asset pricing. Early tightening only slowed down the growth but not enough to derail either credit or equity. Credit felt the pain earlier when the tightening ratcheted up further. Toward the end, the hawkish Fed knocked down everybody until it turned dovish. This is the old playbook.

This tightening cycle is different, as we have discussed extensively from different aspects in the earlier letters (here). The Great Distortion led to a financial asset bubble and inflationary shock. To control inflation, the front-loaded hiking has to be so aggressive that it squeezes the bubble out of financial assets and the real economy. That is what happened: both equities and credits fell in tandem since the beginning of this inflation fight(Chart 2). That is what we missed.

Nonetheless, we believe this inflation fight has come to an end. We enter the second half of the tightening cycle, where growth might get back in the driver’s seat. The financial assets will have to navigate between “soft-landing” and “recession” narratives in the coming months. We will see.

Esoterica's statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. For full disclosures, click here.