How to Build a Three-Fund Portfolio

1. What is a three-fund portfolio and how does it work?

A three-fund portfolio is a low cost and time-efficient way for the average person to build wealth, while also having sufficient diversification to preserve and protect your wealth as you go.

The naïve or benchmark version of the 3-fund approach allocates wealth equally across two equity index funds -- generally one domestic equity fund and one international -- and one fixed income index fund. All three funds are typically passive, market capitalization-weighted, index funds. Alternative versions call for asset allocation schemes that vary the bond allocation based on the age of the investor (starting savers versus retirees) and/or the risk tolerance of the investor.

2. What type of investor does this approach best suit?

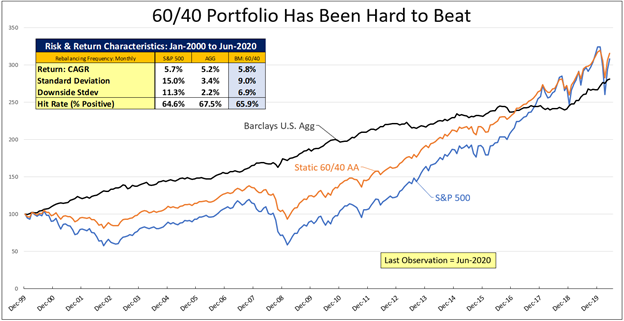

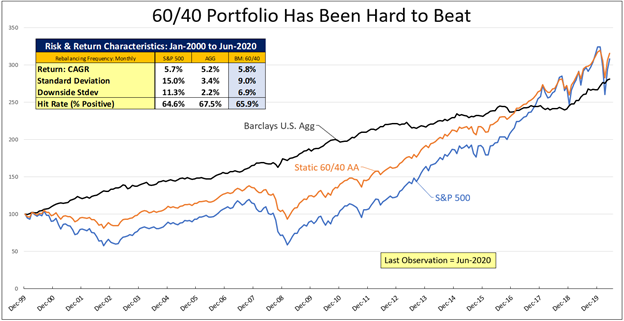

The 3-fund portfolio is potentially applicable to all investors. It is essentially an updated version of the classic 60/40 stock-bond portfolio. Over the last 20 years, the classic 60/40 U.S. portfolio has outperformed the all-equity (S&P 500) portfolio, in spite of the longest bull market in capital market history. See below. The 60% S&P 500 /40% U.S. Agg portfolio has achieved this outperformance while also exposing the investor to a 40% reduction in risk. In short, the 3-fund passive approach is a proven way for investors to build wealth, and experience a much smoother ride in the process. Market capitalization-weighted index funds are shunned by stock-pickers, but scientific research shows few active money managers and/or hedge funds have actually been able to consistently outperform. The historical effectiveness of the simple 3-fund approach, combined with its low costs and low time commitment, make it a suitable consideration for the core-holdings of all investors.

Close

3. What are the pros/cons of using a three-fund approach to investing?

The key advantages are: (i) low costs, (ii) ease of implementation, (iii) low on-going time commitment (maintenance), and (iv) effectiveness, in terms of risk and return. There is another huge advantage that many overlook; the passive cap-weighted indices evolve in response to structural shifts/changes. For example, increased “green” policies-and-attitudes have resulted in a consistent decline in the Energy sector weight within the S&P 500, while the ever-growing digital economy trend is reflected in a consistent increase in the Tech sector weight. The demographic shift, in the average age of the U.S. consumer, can also be seen in the expanding size of the Health Care sector weight.

The biggest disadvantage of the 3-fund approach is that it is not sexy. It is, in some sense, the anti-bitcoin or the anti-Robinhood investment strategy. No one is going to brag to their friends, neighbors, co-workers, or gym associates, about this strategy. Effective yes, sexy no.

4. What are your best tips for building a three-fund portfolio?

Investors in the 3-fund approach should consider the big picture. In the last 100 years, the U.S. has migrated from being an agriculturally based economy to an industrial-based economy, to today’s technology-based economy. Furthermore, it is no longer the U.S. versus the rest-of-the-world; it is a two-horse race today between the U.S. and China. The tech race is predominately between the U.S. and China. The military race is between the U.S. and China, and the consumption race is between the same two. Investors pursuing the 3-fund portfolio should consider the two passive equity funds to be the U.S. (e.g., S&P 500) and China (e.g., CSI 300).

3-fund investors should also carefully consider their passive bond fund. The twin deficits in the U.S. – fiscal or budget deficit and current account or trade deficit – are unsustainable. At some point, the market effects of the twin-deficits will likely result in dramatic currency (US$) weakness and increased credit concerns. The global Aggregate bond index fund may be preferred to the conventional U.S. Agg due to (i) its higher yield and (ii) its exposure to 24 different investment-grade bond and currency markets. This small change in the typical bond fund would allow 3-fund investors to maintain fixed-rate, investment-grade, bond exposure with sufficient diversification.

5. What mistakes should an investor watch out for when building a three-fund portfolio?

The biggest mistake is myopia. Investors should consider the big picture setting for the next 20-plus years and not be overly biased by today’s events (e.g., the healthcare and financial crises of today will pass). There is, for example, a non-trivial chance that the U.S. will lose its reserve currency status at some point. There is also a possibility that the MMT-like strategies that are now being employed in the U.S., will subsequently generate concerning inflation levels. Finally, the tremendous U.S. fiscal and monetary balance sheet expansions, that we are witnessing today, cannot continue forever.

These big picture considerations, and the corresponding transmission channels, should be incorporated in the three asset classes chosen by 3-fund investors.

The cold war between the U.S. and China will likely linger for the next twenty, or so, years and who knows which side is likely to be the disproportionate winner. In addition, if the U.S. experiences a spike in inflation and/or a currency devaluation, the commodity-based emerging market debt issuers, included in the Global Agg, will at least partially offset the dire consumption and earnings effects of inflation and currency risks. Finally, the ultimate withdrawal of today’s abundance QE liquidity may result in a decade, or so, of low single-digit equity returns for domestic and other developed markets.

It has been said, change is the only constant in investments; 3-fund investors should be proactive and plan ahead for some of the most likely coming changes, via their selection of the three asset classes.

Esoterica's statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. For full disclosures, click here.