A Primer on Risk Factors

The intent of this white paper is to review the theory and practice of risk factors.

I. Setting the Stage

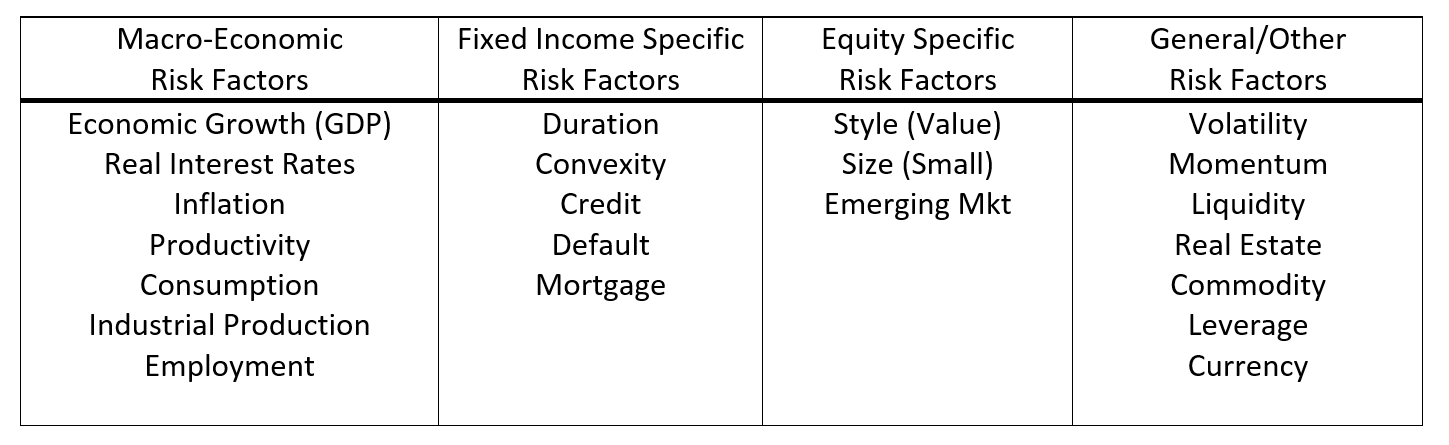

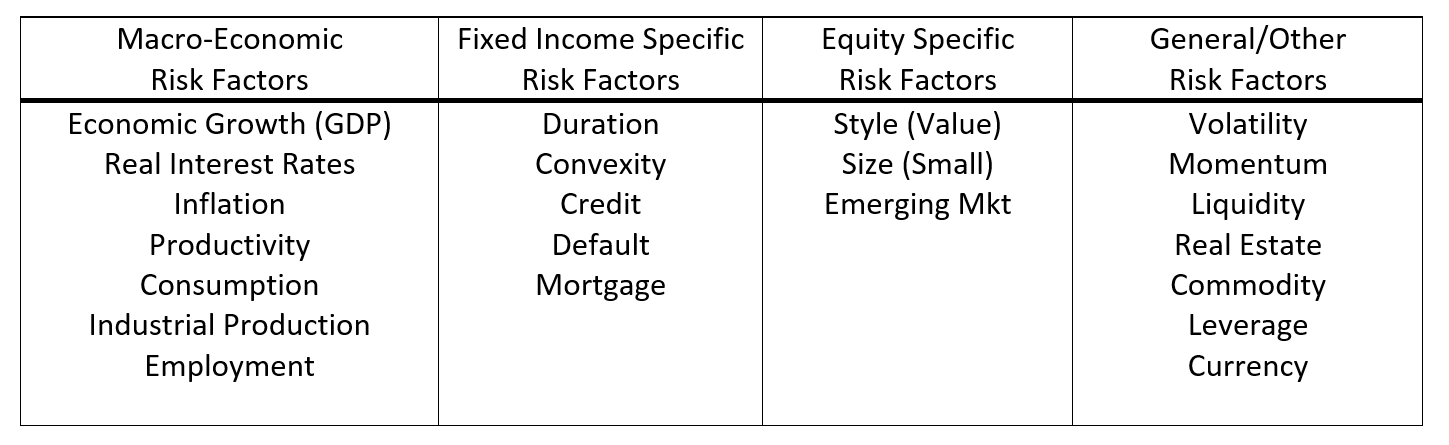

The process of constructing portfolios occurs in many different ways. The most widely adopted, traditional Markowitz approach, is to treat the individual asset classes, such as stocks and bonds, as the portfolio building blocks. A newer approach to portfolio construction entails decomposing the risk premium of each asset class into its individual components or factors. The risk-premium-decomposition approach treats the so-called “risk factors” as the portfolio building blocks. Risk factors are the systematic components underlying the risk and return drivers for each asset class. Take corporate bonds for example; corporate bonds can be viewed as an individual asset class or, equivalently, as a bundle of underlying risk factors such as duration, credit and liquidity. Financial theory does not provide a complete list of the individual risk factors, however the most frequently cited risk factors are shown in Table 1.

Close

II. Asset Class Diversification vs Risk Factor Diversification

Notice that many asset classes are exposed to similar underlying risk factors.

The primary driver of the equity risk premium, for example, is the economic growth factor. The overlapping nature of the economic growth risk factor, therefore, affects U.S. equities, non-U.S. equities, Emerging Market (EM) equities, credit, etc. and results in an internal correlation across these asset classes. A synchronized drop in economic growth expectations around the world would, therefore, be expected to reduce diversification across the equity and equity-like (credit) asset classes.

U.S. equities and U.S. corporate bonds also share common factor exposures such as volatility, inflation, liquidity and currency. More generally, note that shocks to interest rates (duration) and inflation tend to move stocks and bonds in the same direction and elevate the stock-bond correlations (i.e., falling interest rates and/or declining inflation tend to push both stock and bond prices higher). On the other hand, an economic shock, such as falling economic growth, tends to move stocks and bonds in opposite directions and depress the stock-bond correlation (i.e., falling economic growth tends to be associated with lower corporate profits and reduced yields on longer term bonds).

We have all witnessed episodes when asset class diversification largely disappears and an understanding of common risk factors can aid in understanding the causes of this event. Asset classes that are seemingly uncorrelated during tranquil market environments can lose that distinction during times of market stress, due to the overlapping underlying risk factors across asset classes becoming highly rewarded.

The entire factor-based optimization process works as follows:

Identify rewarded risk factors (discussed in Section I and II). Then,

Map these compensated risk factors to investable strategies (discussed next). Finally,

Appropriately allocate the investment capital across the risk factors (see Section IV).

III. Investing in Risk Factors

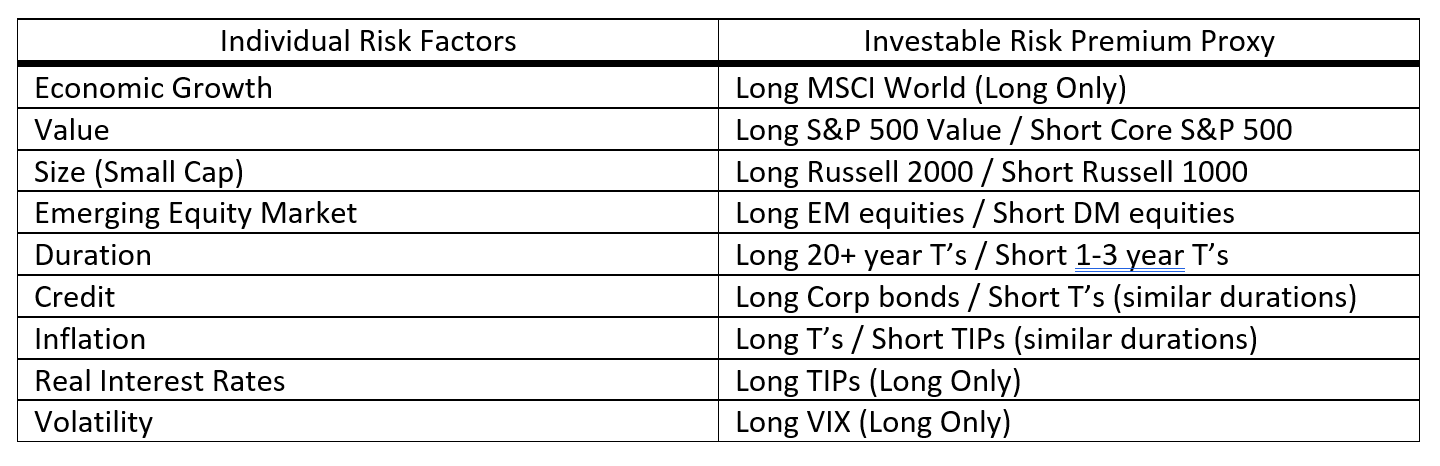

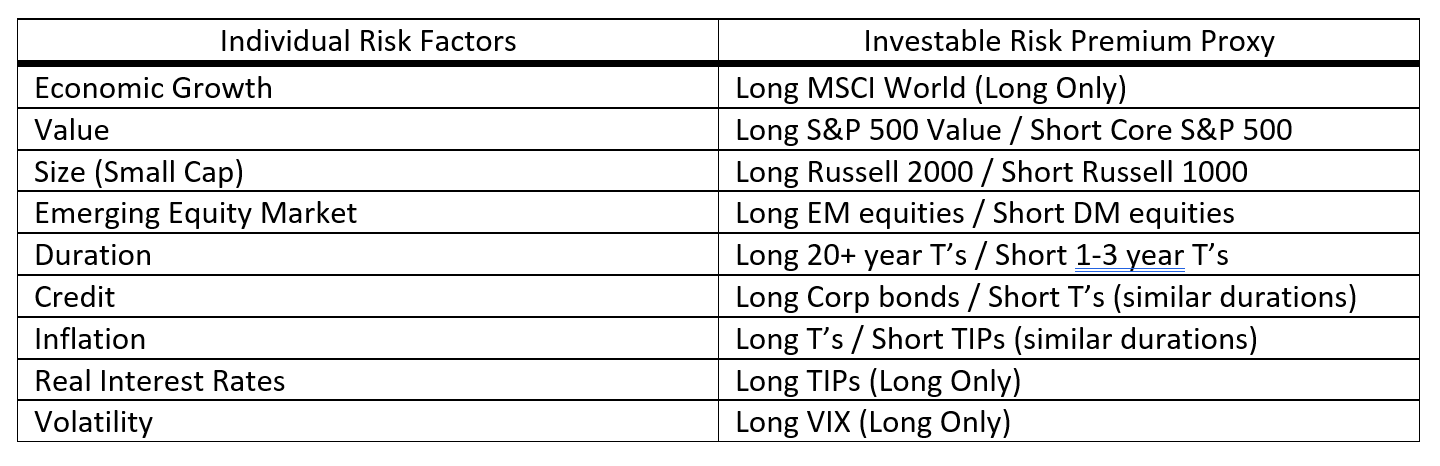

Operationalizing the risk factor framework requires (i) being able to directly invest in the individual factors (or commercially available investable proxies) and (ii) being able to estimate the factor expected returns, risks and pairwise factor correlations. Gaining exposure to some specific risk factors, such as liquidity or convexity, can be challenging, while establishing exposure to other risk factors is simpler. Table 2 lists some possible risk factor proxies.

Close

A comparison of Tables 1 and 2 reveals that there is not an effective and practical way to invest in some of the risk factors. Table 2 also shows that direct isolated factor exposure often requires shorting. These two reasons have prevented widespread adoption of factor-based investing by some practitioners.

What about the plethora of so-called “smart beta” products as a way to get tradeable factor exposure? Smart beta ETF products focus on specific risk factors/attributes such as size, value, dividend yield, quality, volatility and momentum. In simple terms, the rules-based approach for smart beta products works as follows:

Stocks are ranked on a specific risk factor, say a value metric such as price-to-book value; then

The poorest ranking stocks are removed from consideration (i.e., the high P/B stocks are ignored based on over valuation concerns); and finally,

The asset weights/allocations are strategically determined, not based on size (market capitalization), but based on an alternative weighting scheme.

This final point is very important: stocks in a smart beta framework are held – not in proportion to their capitalization weights – but how they ranked in the objective factor screening process. Some smart beta products concentrate on a single risk factor (e.g., momentum) while others take a multifactor approach (e.g., low volatility momentum stocks).

Smart beta products are arguably most interesting due to their non-capitalization weighting schemes. Yet, they also provide an investable way to get a type of factor exposure, but not isolated factor exposure. Consider the smart beta value ETF as an example; it provides exposure to the value factor as well as the economic growth factor (in other words, the systematic equity risk premium is included as well).

IV. Optimization & Portfolio Building

When each asset class is thought of as bundle of risk factors, this changes the way we think about portfolio construction, but not the science of portfolio construction. To see this, notice that the Markowitz framework applies equally to risk factors and asset classes.

Most importantly, the Markowitz optimization opportunity set shifts from stocks/bonds/ alternatives to risk factors such as economic growth, interest rates, inflation, etc. Hence, risk factor diversification becomes the key risk metric in the optimization process, replacing asset class diversification.

Operationalizing the Markowitz framework requires the same inputs whether either risk factors or asset classes are used. The required inputs are expected returns, volatilities and correlations.

The proposition of factor-based risk management is that it will generate superior risk-adjusted portfolio returns that are also more robust across diverse economic environments.

Esoterica's statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. For full disclosures, click here.